If you didn’t have medical coverage or Medi-Cal in 2024, you may be subject to a fine when you file taxes this year.

Just recently, a patient came by Clinica Romero trying to sign up for Covered California, the insurance marketplace for state residents who don’t get health insurance through their jobs or earn too much money to qualify for Medi-Cal.

“She wanted to sign up for now until the tax filing deadline to avoid the fine, but it doesn’t work that way,” explained Azhalia Rosas, Membership Development Coordinator at Clinica Romero who helps process Covered California applications,

If you didn’t have medical coverage or Medi-Cal in 2024, you may be subject to a fine when you file taxes this year.

“The amount of the fines depends on the person’s income and the number of family members,” Rosas said. “It can go from $800 to $2,500.”

You can avoid paying a similar fine next year by signing up for Covered California. The open enrollment period expired on March 18 (after it was extended due to the fires), but paying a fine qualifies as a “life event” that allows you to enroll in the program outside of that open enrollment period.

LIFE EVENTS

Life events cover a number of special circumstances, including:

Paying a fine for not having medical coverage in the previous year: “just bring the letter saying that you have to pay the fine and we can enroll you,” Rosas says.

*If you no longer qualify for Medi-Cal: “people can enroll as soon as they are notified their coverage is terminated”

*If you recently move to California from another state

*If you got married/divorced

*If you had a baby or adopted a child

*If one of your children reaches adulthood and is no longer your dependent

*If your name was changed in any way

*If your income drop or increased dramatically

*If you immigration status changed

*If you just got out of jail

Any of those events allow you to enroll (if you qualify) in Covered California within the next 60 days. After those 60 days, you won’t be able to enroll again.

You must present proof of these life event changes, including letters, checks stubs, or other documents.

Those who were enrolled in Medi-Cal but are told they no longer qualify can apply for Covered Californai 60 days before and 60 days after their coverage is set to expire.

APPLYING TO COVERED CALIFORNIA

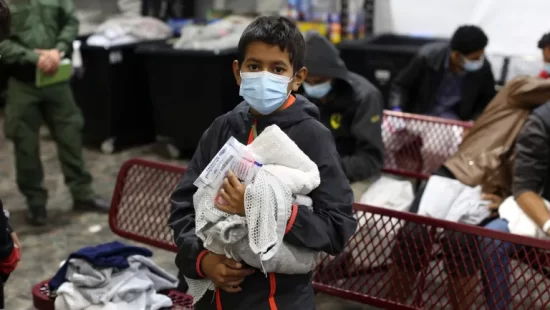

To qualify for Covered California you must have TPS (Temporary Protected Status), be a citizen, permanent resident or have protection under DACA (Deferred Action for Childhood Arrivals).

To process a Covered California application, you must present the previous year’s income taxes, check stubs or other documents showing proof of income.

These documents and the number of family members will determine if you qualify for Covered California or Medi-Cal. In some cases, some members of the same family will qualify for Medi-Cal and others for Covered California.

Payment and subsidies for the Covered California insurance plans vary depending on income and family size. About 90 percent of people who enroll receive some amount of financial help. Some families will have a zero monthly premium but they will have co-payments for doctor’s visits, medications, visits to specialists, or for a visit to the emergency room that runs from $5 to up to $90.

Covered California only covers the medical part; if you need vision and dental insurance, you must pay extra for that.

Rosas encourages those who’ve had a life event and lack medical coverage to take this opportunity to enroll in Covered California.

“You can only use a life event once in a calendar year,” she notes.